Are you looking for a high growth mid cap stock to invest in 2026? KPR Mill share could be the perfect choice, as it represents one of the leading textile manufacturers with strong growth potential.

KPR Mill Ltd is one of the largest vertically integrated textile companies in India. It operates diversified business segments such as, yarn, fabrics, garments manufacturing, and white crystal sugar production.

In this blog, we are going to cover everything that you need to know for investment perspective, such as company’s financial performance, competitive advantages, risks, future outlook and growth potential.

Note: All financial data shown in this blog is according to annual report(FY2024-25) of KPR mill.

About KPR Mill limited

KPR Mill is one of the leading vertically integrated textile and apparel manufacturing companies in India. It is known for its strong financial performance and consistent business growth, which has positively supported the long-term growth of the KPR Mill share.

- Founded: 1984

- Headquarter: Coimbatore, Tamil Nadu, India

- Founder & Chairman: K.P. Ramasamy

- Business type: Vertically integrated textile and apparel manufacturing company

- Market Cap: 31,102 crores ( Mid-Cap stock)

- Global presence: 60+ countries

KPR Mill mainly operates in four business segments:

- Yarn manufacturing

- Fabric production

- Garment manufacturing

- Sugar production

KPR Mill plays a major role in India’s textile export industry and has built a reputation as a high-quality garments manufacturer globally. It has grown from a small spinning mill to a globally recognised textile and apparel manufacturer and exporter. Its strong business expansion, makes the KPR Mill share attractive for long-term investors looking for growth oriented textile stocks.

Business Model of KPR Mill

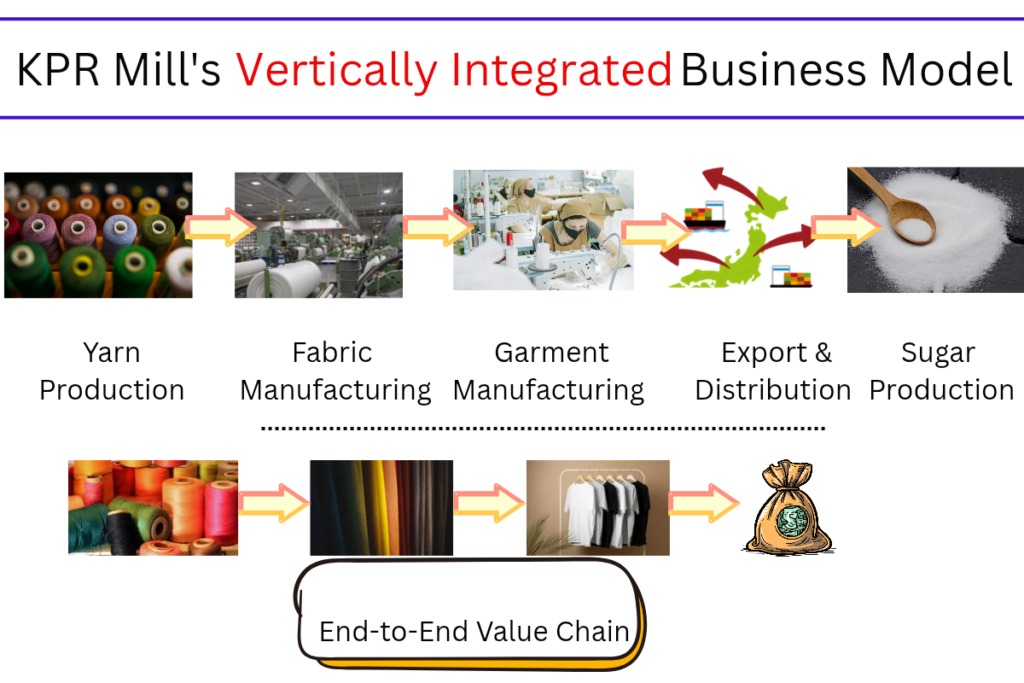

KPR Mill follows a vertically integrated business model, it operates across the entire textile value chain, from yarn manufacturing to fabric production, garment manufacturing, and sugar production.

This vertically integrated business model is one of the biggest strengths and competitive advantages of KPR Mill. It helps the company to reduce its production cost and maintain product quality.

KPR Mill manufacturers high-quality garments and exports them to global markets such as USA and Europe. Its strong export presence, efficient operations, and integrated manufacturing capabilities ensure stable revenue and profitability, makes the KPR Mill share attractive for long-term investors.

Financial Performance of KPR Mill Share

Before Investing in KPR Mill share it is important to analysis its financial performance.

In FY 2024-25, KPR Mill has delivered a stable and strong financial performance because of its vertically integrated business model. Its business model allows company to control costs and improve efficiency at every stage of production.

The company has shown steady revenue growth and maintained good profit levels, even though the global textile industry faced some challenges.

Key Highlights of KPR Mill Share in FY 2024-25

- Total Revenue: 6,462 crores

- Assets: 4,776 crores

- PBDIT: 1,320 crores

- PBT: 1,062 crores

- PAT(Net Profit) : 815 crores

- EPS: 23.85

KPR Mill shares are becoming fundamentally strong with consistent revenue growth, high profitability, and strong financial stability, that makes it a strong stock for long-term wealth creation.

Financial Performance of KPR Mill Share in Recent 5 Years

The Financial performance of KPR Mill has been strong and stable over the last 5 years.

1. Strong Revenue Growth

KPR Mill has experienced consistent revenue growth over the last 5 years. The company has benefited from strong demand in textile export sector and it’s integrated business model helped it to reduce production costs and increases efficiency, that supports revenue growth.

2. Consistent Profit Growth

KPR Mill has maintained strong profit growth over the years. Its net profit has increased due to effective cost control, expansion in garments production, and use of renewal energy.

3. Good Profit Margin

KPR Mill has consistently maintained good operating and net profit margins. This shows that the company is able to control its expenses and generate good profit from its operations.

Its vertically integrated business model allows it to reduce dependency on outsider supplier, that improves it’s margin stability.

4. Strong Financial Health of the Company

KPR Mill has strong financial health because it maintain low debt, high profitability, and strong cash reserves. Strong financial health makes the company more stable and reliable for long-term growth.

Financial Ratio Analysis of KPR Mill Share

Before investing in KPR Mill share it is necessary to analyse financial ratios, to understand its profitability and financial condition.

Financial Ratios | Value | What it Means | Analysis |

ROE | ~17% | ROE shows the profit generated from shareholders money | Strong profitability |

ROCE | ~20% | ROCE shows how efficiently company uses total capital | Excellent capital efficiency |

ROA | ~13% | ROA shows how efficiently company uses its assets to generate profit | Good assets utilisation |

Debt-to-Equity Ratio | 0.06 | It shows how much debt company has in comparison to equity | Low debt, financially strong |

Current Ratio | ~6 | It shows ability to pay short-term liabilities | Financially stable |

Interest Coverage Ratio | ~24 | It shows ability to pay interest | High financial stability |

Competitive Advantages of KPR Mill Share

Before investing in KPR Mill Share, it is important to understand what makes KPR Mill different from other textile companies. KPR Mill has several unique competitive advantages that differentiate it from other textile companies.

1. Vertically Integrated Business Model

Vertically integrated business model is the biggest competitive advantage of KPR Mill. The company operates across the entire textile value chain.

Because of its vertically Integrated business model, It does not depend heavily on outside supplier for yarn and fabric to produce garments. This allows company to control its production cost and increases its profit margin during price fluctuations of raw material.

2. Strong Global Presence

One of the biggest competitive advantages of KPR Mill is its strong global presence, it has global presence over 60 countries. KPR Milk is a major garments exporter of readymade garments, it supplies products to many international markets.

KPR Mill has built long-term relationship with global clients by maintaining high product quality and timely delivery. Global presence of company helps it to generate stable revenue, high profit margins, and long-term growth.

3. Large Manufacturing Capacity

One of the most important competitive advantages of KPR Mill Share is its large manufacturing capacity. This large manufacturing capacity allows company to fulfill the both domestic and international demand efficiently and helps it to grow faster and maintain strong profitability.

KPR Mill operates multiple modern manufacturing plants equipped with advanced machines and automation. Its large manufacturing capacity makes it a reliable supplier for global clients.

This competitive advantage helps KPR Mill to maintain strong profitability and makes KPR Mill Share an attractive option for long-term investors looking to invest in textile sector.

4. Strong Financial Performance

Financial performance of KPR Mill is strong, its revenue is consistently growing, earning hai profit and managing its expenses efficiently and It has low debt, strong profit margins. Strong financial performance makes it fundamentally strong company and a good long-term investment option.

Strong financial performance is a strong competitive advantages of KPR Mill that makes it a attractive and reliable investment opportunity.

5. Cost Efficiency Through Renewable Energy Investments

Textile companies requires a large amount of electricity for spinning yarn, processing fabric, and producing garments. Electricity(power) is one of the biggest operating expenses for textile companies.

KPR Mill has invested heavily in renewal energy sources like wind and solar power, to reduce its operating cost and improve profit margin. Renewal energy investment helps the company to reduce electricity expenses, increases cost Efficiency and strengthen the long-term profitability of KPR Mill share.

Future Growth Prospects of KPR Mill Share

KPR Mill Share has strong future growth prospects, driven by capacity expansion strategy, growing export demand, cost efficiency, and strong financial condition. These strengths help the company to increase its revenue and profitability,making KPR Mill share a good and promising long-term investment option for investors.

1. Capacity Expansion Supporting Future Growth

Capacity expansion is one of the most important strength of KPR Mill that supports it future growth. Capacity expansion means increasing, the company is increasing its production capacity so it can manufacture more products and meet growing demand.

KPR Mill is continuously expanding its garment manufacturing capacity, which is its most profitable business segment. Capacity expansion helps the company to increase its revenue, profitability, and it strengthen company’s position in textile sector.

Capacity expansion is a positive sign for investors because it shows that the company is planning for future growth.

2. Automation and Technology Adoption

KPR Mill is actively adopting automation and modern technology to improve efficiency and reduce production costs. It uses advanced machines, automated production systems, and digital technology to increase manufacturing speed and improve product quality.

Automation helps reduce manual work, minimise human errors, and ensure consistent production, which improves efficiency, product quality, and overall operational performance.

Technology adoption allows company to monitor production, manage inventory, and optimise resources more effectively.

Automation and technology adoption is a major growth factor.

3. Strong Financial Position

KPR Mill’s financial position is strong, it earns healthy revenue, generates consistent Profits, maintains low debt, and has sufficient cash to run its operations smoothly. Its stable earnings, efficient operations, and disciplined financial management have helped it remain financially strong over the years.

It’s strong financial position and cash flow allows it to expand its production capacity, adopt modern technology, and support long-term business growth with low financial risk. Strong cash flow ensures smooth business operations and support future growth.

Its efficient cost management and use of renewal energy helps reducing operating expenses and improve profit margins. Strong financial position is one of the key growth driver of KPR Mill in future.

4. Strong Growth in Export Demand

Strong growth in export demand is expected to be a key growth driver for KPR Mill in future. It export garments to over 60 countries, includes Europe, North America, and Australia. Global demand of textile and garment products is increasing rapidly.

KPR Mill is well positioned to increase its export revenue in future due to its large garment manufacturing capacity and strong relationships with global clients. It can utilise its expanded production capacity to fulfill increasing export demand.

Increasing export demand will help the company improve its profitability and overall financial performance.

5. Focus on High Margin Garment Segment

KPR Mill is strongly focusing on its high-margin garment segment because it generates better profits as compared to yarn and fabric. Global demand of garments is high in comparison to yarn and fabric.

KPR Mill is expanding garment production capacity, to increase sales and improve overall profit margins. In long-term, focusing on high margin garments segments can strengthens its financial performance, and enhance shareholder value.

Investment Risks Associated with KPR Mill Share

KPR Mill is a a fundamentally strong company with strong growth potential, but like every stock, it also carries certain risks, so as a investor we have to understand the risks associated with it.

1. Global Market Dependency Risk

KPR Mill generates a specific portion of its revenue from global market, especially from countries like USA and Europe. This global dependency creates a risk because global demand can fluctuate due to economic slowdowns, inflation, and geopolitical issues.

Export-oriented companies like KPR Mill are always exposed to global market uncertainty, which can impact their revenue, profit and share performance.

2. Raw Material Price Fluctuations Risk

KPR Mill follows vertically integrated business model, where cotton is primary raw material used to manufacture yarn, fabric, and garments. Cotton prices are volatile and can increase due to weather conditions, supply shortages or global demand.

This fluctuations in cotton prices can increase production costs and impacts the company’s profit margins.

3. High Competition in Textile Sector

There is high Competition in textile and garment sector, both in India and globally. KPR Mill competes with many textile manufacturers. Because of high competition, there is always a pressure to reduce price which can leads to low profit margins.

4. Expansion and Capital Investment Risk

Expansion and capital investment risk is one of the major risk associated with KPR Mill share. While large investment is good to generate strong returns, if market conditions are unfavorable, it can impact its revenue, profit margins and overall financial performance.

5. Exposure to Textile Industry Cycles

Textile industry is cyclical in nature, means demand rise and fall with economic condition. When global economy is strong, people spend more on clothing and fashion, which leads to high demand of garments and textile results in high sales and high profit. When global economy is weak, people spend low on clothing and fashion, which leads to low demand of garments and textile results in low sales and low profit.

Is KPR Mill Share Good for Long-Term Investment?

KPR Mill is considered as one of the fundamentally strong textile companies in India. KPR Mill Share can attract long-term investors because of its vertically integrated business model, strong financial performance, and consistent profit growth.

It operates across entire textile value chain, which helps it to control production costs and improve profit margins. Over the years KPR Mill share has delivered steady revenue growth and strong financial performance, makes it suitable for long-term investors.

Its strong fundamentals and competitive advantages make it a promising long-term investment opti

FAQs

Is KPR Mill is a good stock to buy?

Yes, KPR Mill is a fundamentally strong stock to buy. Its vertically integrated business model makes it strong and reliable share to buy.

Who is the founder and chairman of KPR Mill?

K.P Ramasamy is the founder and chairman of KPR Mill.

Who are the Top competitors of KPR Mill?

Vardhman Textile, Welspun Living, Trident, Kitex Garments are top competitors of KPR Mill.