If you are searching for a reliable and growing financial company in India, then your search ends here, as L&T Finance is perfectly suited for your search. L&T Finance Share has earned investors trust over the years because of continuous Profitability, strong digital transformation, and a clear retail focus.

In this blog we are going to discuss 5 Powerful reasons to invest in L&T Finance Share.

About L&T Finance

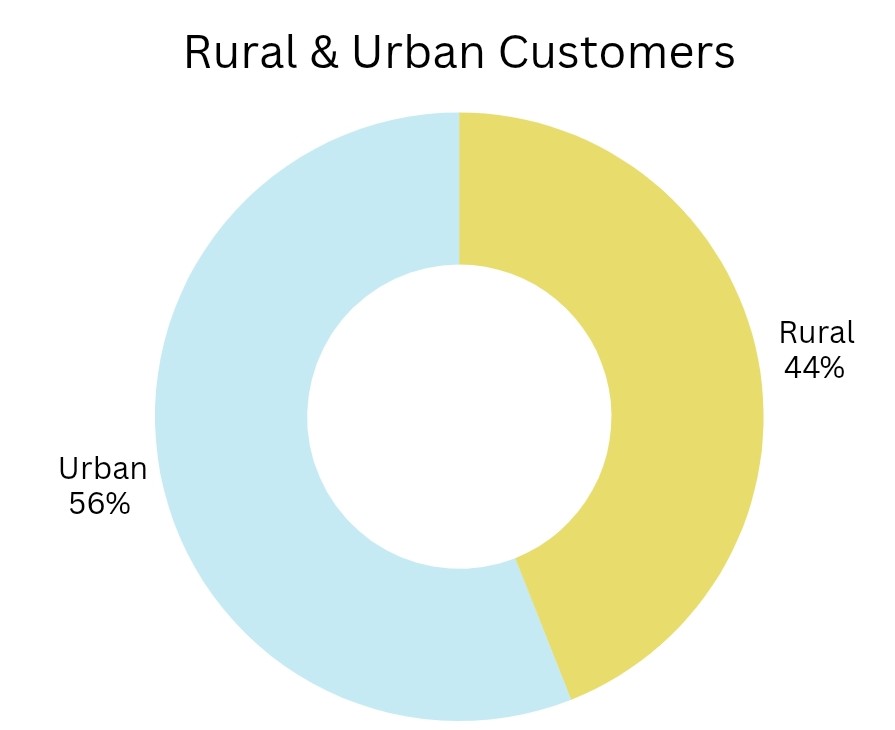

L&T Finance Limited is a significant upper-tier Non-Banking Financial Company in India, that provides lending options and caters to diverse financial needs of both urban and rural customers. Its headquarter is in Mumbai, and it is a part of L&T Group.

The company operates through a large network of branches across India, that ensures widespread access to financial services and fulfill different financial needs of individuals and communities across borders. It aggressively promotes financial stability by providing products and services to society’s to week and marginalised groups.

L&T Finance has received the highest credit rating ‘AAA’ from 4 popular rating companies. It has received top-notch ESG Ratings, that reflects it’s commitment to sustainability.

After 3 decades of performance, it has become a leading NBFC in India, it contributes significantly to the country’s financial ecosystem. The company has been committed to empowers individuals and businesses by delivering financial solutions that connects aspirations to opportunities.

Key Achievements of L&T finance –

- ~2.6 crore, Customer Database

- 100% Digital Disbursement(Rural+Urban)

- 13,000+ Distribution Touchpoints

- ₹ 3,800 crore+ Digital Collection(Planet App)

- ₹ 12,700 crore+ Digital Sourcing (Planet Apo)

- 685 lakh+ Customer Servicing Experience through Digital Channels

- ~2 lakh Villages Served

- 2,296 Branches Pan India

Powerful REASONS to Invest In L&T Finance

Lets discuss the 5 Powerful reasons to invest in L&T Finance share.

- Diversified Business Model

- Strong Brand Legacy and Trust of L&T Group

- Strong Financial Performance

- Digital Transformation and Technology Adoption

- Customers Centricity

1. Diversified Business Model

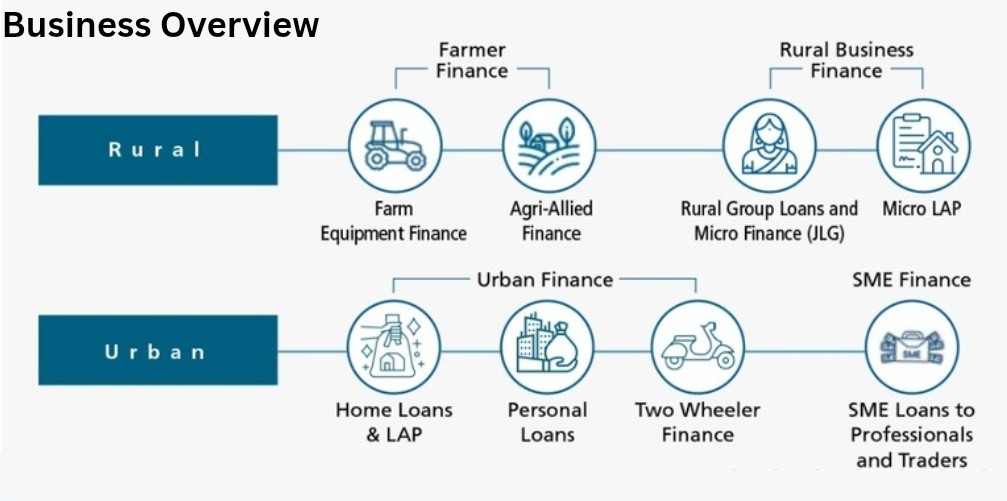

L&T Finance operates a diversified business model, which is a major reason to invest in it, because it contributes to company’s success and growth. This business model enables company to earn from various sectors.

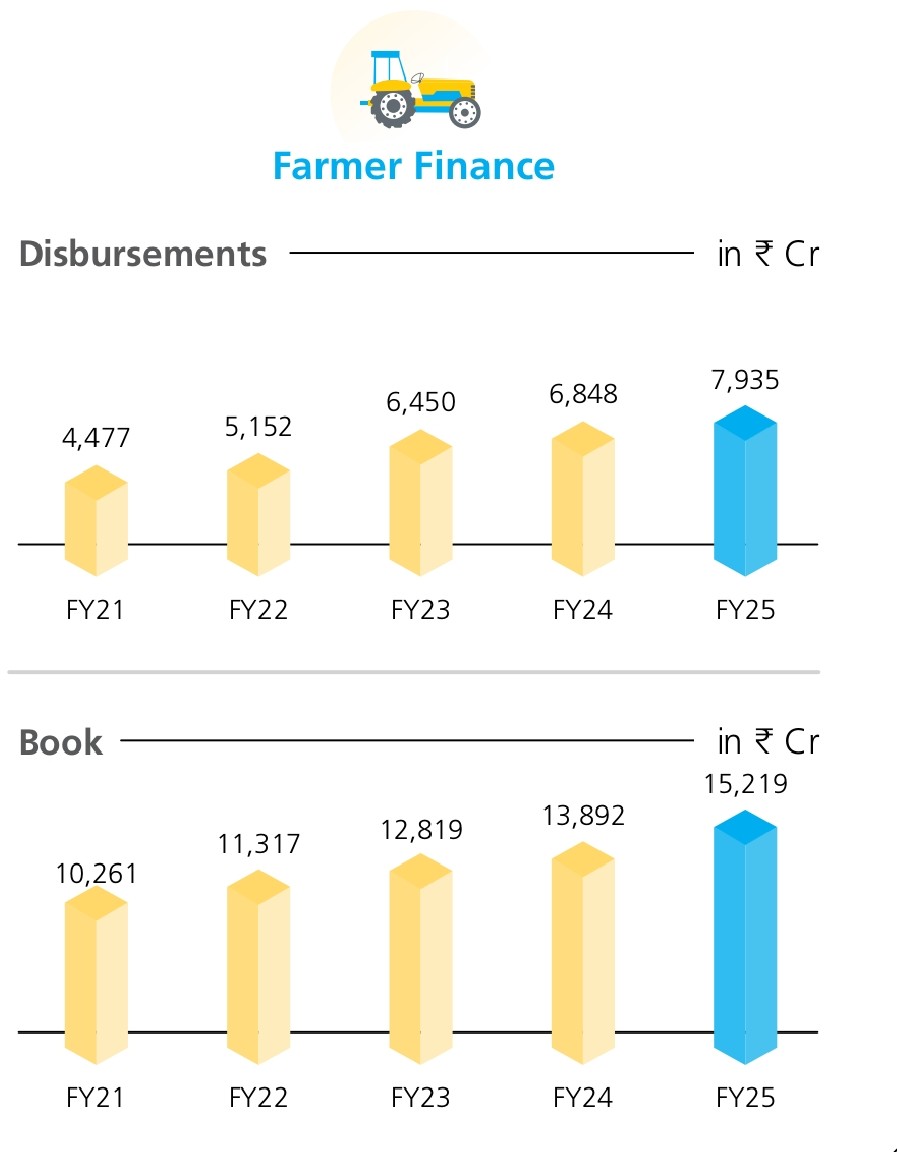

(A). Farmer Finance

In farmer finance, company aims to provide products and services that can fulfill the farmers needs throughout the agriculture value chain, farm equipment finance and warehouse receipting finance.

The company remains a top farm equipment financier, with consistent disbursements and good relationship with dealers and OEMs.

L&T Finance has financed over 96,000 new tractors, by using best- in-class digital architecture and a paperless sourcing process. The paperless sourcing process is supported by an in-house employee-assisted app and a pilot of Project Cyclops, a unique underwriting engine that uses multiple data sources such as account aggregators, satellite-based land data, credit history, and hyperlocal demographics.

The company is Integrating advanced services such as real-time online land details, geospatial data, hyperlocal demographic data, decile-based customer profiling, and video personal discussions with electronic mandate registration is expected to improve sourcing quality and enhance customer onboarding experience, resulting in industry-best TAT.

The company expanded its product offerings by introducing Warehouse Receipting Finance a few years ago to address post harvest demands in the agricultural value chain.

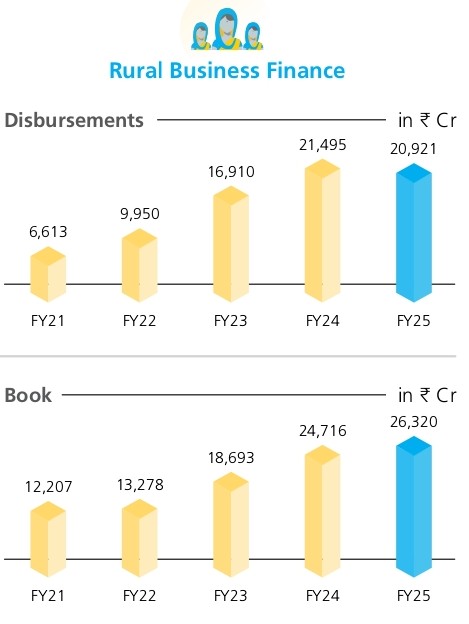

(B). Rural Business Finance

In Rural Business Finance, company offers various loans for rural communities, that includes group loans, the Vikaas Loan for women, and the Agri Implement Loan for farm equipment. The company focuses on supporting rural growth through specific loan solutions for businesses in rural areas.

In FY25, it empowered over 6.1 million women entrepreneurs through calibrated growth and a strong rural network of over 2,000 meeting centres in rural areas and 14,000+ on field workforce.

The company has established the Micro Loan Against property product to meet the financial needs of a specific rural community, mostly for self-occupied residential property. In FY25 Micro Loan Against property(LAP) product expanded into 132 branches in Tamil Nadu, Karnataka, Maharashtra, Gujarat, Andhra Pradesh, and Telangana.

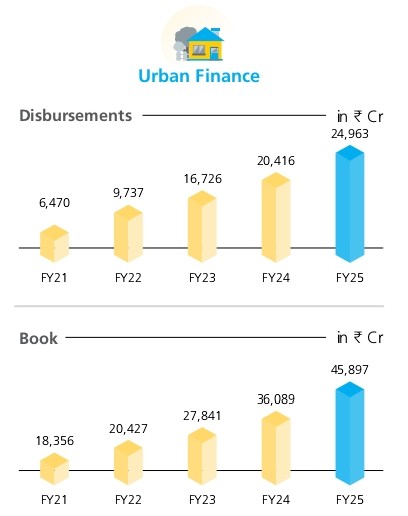

(C). Urban Finance

In Urban Finance, company offers financial services to customers living in cities and semi-urban areas, mainly for buying homes, vehicles, and consumer products.

Two wheeler finance, This is a financing solution for consumers looking to buy a new bike, with features such as up to 100% funding, competitive interest rate, and a flexible repayment schedule.

Loan Against Property, Through this feature urban property owners can get a loan by keeping their commercial or residential property as security. This allows business owners or inviduals to fund expense.

Personal Loan, L&T Finance provides short term personal loans through a completely digital process, with quick approval, low paperwork, and simple EMIs.

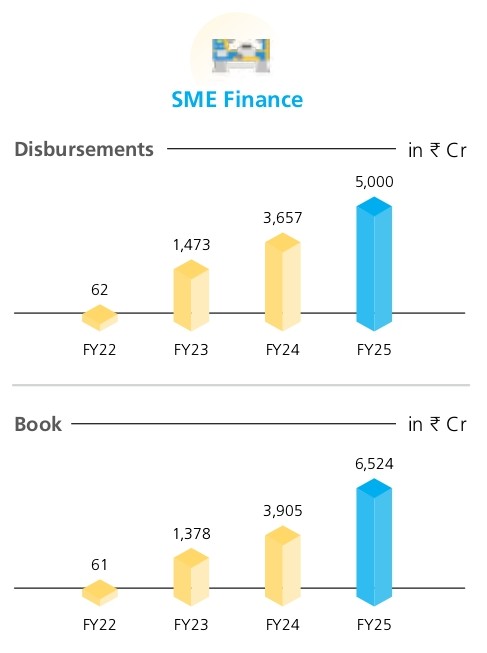

(D). SME Finance

L&T Finance provides SME loans with features like loan upto 5 crores rupees, and quick approval in 3-5 working days for complete applications. India’s economy relies heavily on the Micro, Small, and Medium Enterprises sector, which supports manufacturing, exports, and job creation.

2. Strong Brand Legacy and Trust of L&T Group

One of the main reasons to invest in L&T finance is it’s strong and powerful parent company, the Larsen & Toubro Group. L&T is a strong brand name that has earned enormous trust and reliability in India and around the world.

Being a part of such well-known business group, L&T finance got significant benefits such as – Credibility and Trust, Strong Business Management. The L&T group is well-known for its ethical business practices, competent management, and high transparency.

L&T Group’s strong financial support makes it one of the India’s most financially secure company.

L&T has earned trust through transparency, ethics, and performance. The company has a clean corporate image, strong governance practices, and few controversies.

Customers and Investors believe that any company supported by L&T will follow strong ethics, transparent practices, and long-term visions. That’s why L&T Finance has high reputation in the NBFC sector.

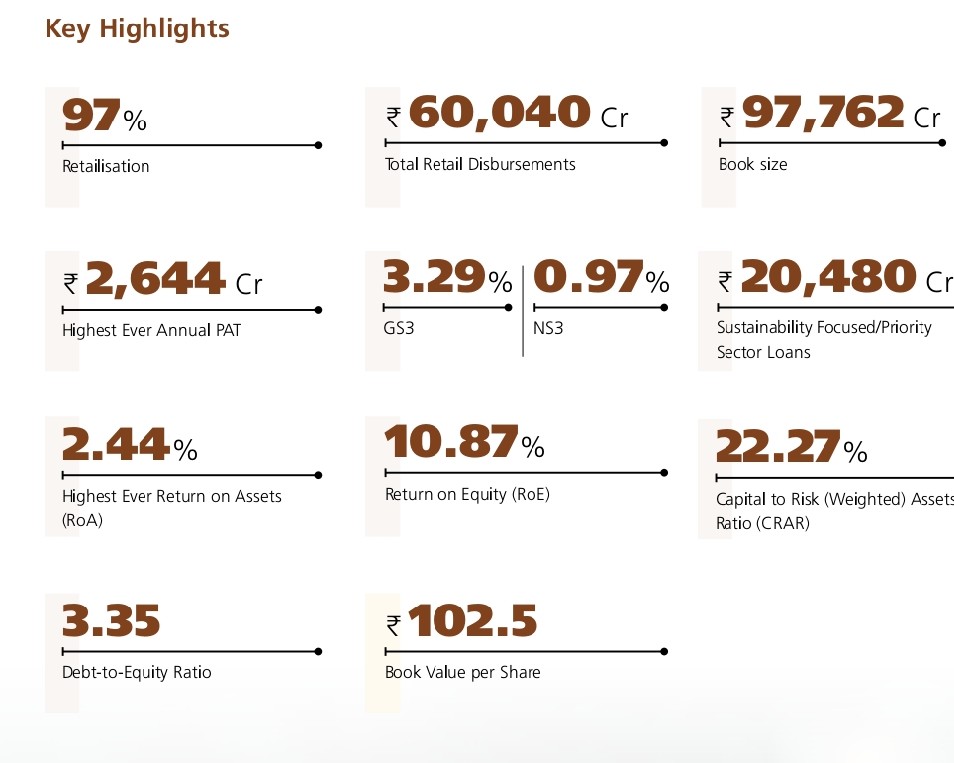

3. Strong Financial Performance

In FY25 LTF maintains its strong financial performance, it achieved record profitability and operational efficiency. LTF’s commitment to a diversified retail lending strategy, which has historically provided stability and resilience during market changes, was reinforced by 97% retailisation of the entire portfolio.

Company’s strong credit governance and risk management strategies and focused collection efforts shows Company’s commitment to strong asset quality.These efforts have led to an increase in consolidated profit after tax (PAT) to ₹2,644.Cr, a 14% year-on-year increase, the highest annual profit after tax (PAT) in your Company’s history.

Company also achieved its highest-ever annual RoA of 2.44%.

4. Digital Transformation and Technology Adoption

L&T Finance has aggressively adopted technology to transform into a digitally enabled, retail-focused fintech company, guided by its lakshy 2026 goal.

The company focuses on digital transformation and uses modern technology to deliver personalized and end efficient consumer experience. By integrating AI, Machine Learning, and automation, company increase its digital capabilities while keeping integrity of human-assisted interactions, ensuring consistent and excellent service quilty throughout.

This digital transformation marks a strategic shift towards automation, self-service digital solutions, AI-Powered risk management, and strengthening IT security.

PLANET App

The PLANET App, launched in March 2022, it has played a transformative role in shifting financial services from traditional branch focused models to a user-friendly, digital-first ecosystem.

The App has improved customers experience with AI driven insights, automated loan processing and smooth integration with WhatsApp and chatbots. It enhanced security protocols and ensures safe digital transactions, multilingual support, and seamless digital experiences, thereby increasing costumers engagement and access.

Planet App has significantly lowered turnaround times and operational expenses in loan servicing and collections, in addition to increasing accessibility to financial services.

Digital EMI payments have reduced the need of call centre engagement. Self-service capabilities allow clients to alter mandates, download statements, and manage loans at their convenience.

PLANET App aims to become a next generation financial ecosystem.

5. Customers Centricity

One of the most powerful reasons to invest in L&T Finance is its strong focus on customers. The company always puts it’s customers first in every decision it makes.

(a). Innovative Offering to Empower Customers

In FY25, the company further strengthened it’s commitment to excellence by offering innovative products, such as Home Decor Finance, to suit the changing demands of its costumers. Company offers various products to increase access to credit, and move towards financial empowerment of rural and underprivileged population.

(B). Building Trust

By putting costumers first in all strategic and operational decesion, company provides personalised and unique solutions to build trust, increase happiness, and foster long-term growth and connection with various client segments.

(c). Costumer Satisfaction

Customer satisfaction remains L&T Finance Company’s top priority, as reflected in its commitment to prompt and decisive engagement with customers. Company ensures efficiency and transparency in loan disbursement process.

(d). Omni-channel Customer Engagement

LTF is dedicated to create a comprehensive omni-channel customer ecosystem that provides a seamless platform for customer engagement. This approach empowers company to anticipate and address customer needs and expectations at every touchpoints, thereby increasing satisfaction and trust.

Target & Achievements of L&T Finance

Target | Achievements |

Become carbon neutral by FY35 | In track to achieve carbon neutrality target by FY35 |

Increase the share of women representation to 8% of total workforce Fy30 | Increased women representation in total workforce from 4.6% to 5.4% in FY25 |

Achievev 3x increase in villages covered through CSR activities by FY28 compared to FY24 | 2x increase in villages covered through CSR activities |

Use of 50% recyced paper in operations by FY25 | Target achieved for stationary savings, except for hard copy sets preserved in compliance with regulatory requirements under applicable law |

Achieve 50,000 tree plantation | 1,00,000 sapling plants plantation |

Conclusion

L&T Finance stands out as a well-balanced and future ready financial company supported by the trust of L&T Group. With strong digital focus, diversified business model, and customer centric approach, company is consistently moving towards sustainable growth.

Its consistent financial performance, prudent risk management, and focus on green financing make it a reliable choice for long-term investors.

Investors, who are looking for a stable, trustworthy and growth potential share, L&T Finance can be a perfect choice for long-term.

Rural Customers served by PLANET App.

PLANET App served 16 Lakh+ rural customers.

How many Employees received long Service Awards in L&T Finance ?

173 Employees received long service awards in L&T Finance.

Competitors of L&T Finance.

Sriram Finance, Bajaj Finance, Muthoot Finance are top competitors of L&T Finance.