Indis’s power sector is going through a huge transformation, and JSW Energy is taking all the right moves. The company’s transformation from a traditional power generator to a renewable energy leader has been remarkable. JSW Energy is quickly becoming a popular choice among smart Investors, because of its ambitious expansion plans, great financial performance, and a clear focus on renewable energy.

Whether you are a long-term investor or simply looking for power sector opportunities, then you need to understand business strategy and growth story of JSW Energy, it provide you a competitive advantage in 2025 and beyond.

In this blog, we are going to discuss everything about JSW Energy, from its business model and finance to its future plans and investment prospects.

About JSW Energy

JSW Energy Limited is a part of the JSW Group, it is one of India’s most respected business group. JSW Energy was established in 1994, and its headquarter is in Mumbai, India.

It is one of India’s leading power companies, that operates across the energy value chain with a diverse portfolio of thermal and renewable assets. The company’s major focus is the shift to a low-carbon economy, with strong plans for increasing renewable energy and energy storage capacity.

In recent years, JSW Energy has steadily expanded its renewable portfolio, improved financial performance, and aligned itself with the government’s push towards green energy.

Business Model of JSW Energy Limited

JSW Energy operates on a diversified business model that ensures stable revenue and sustainable growth. The company initially focused on thermal power generation, over the years it expanded into hydropower, renewable energy, power trading, and energy storage solutions.

1. Power Generation

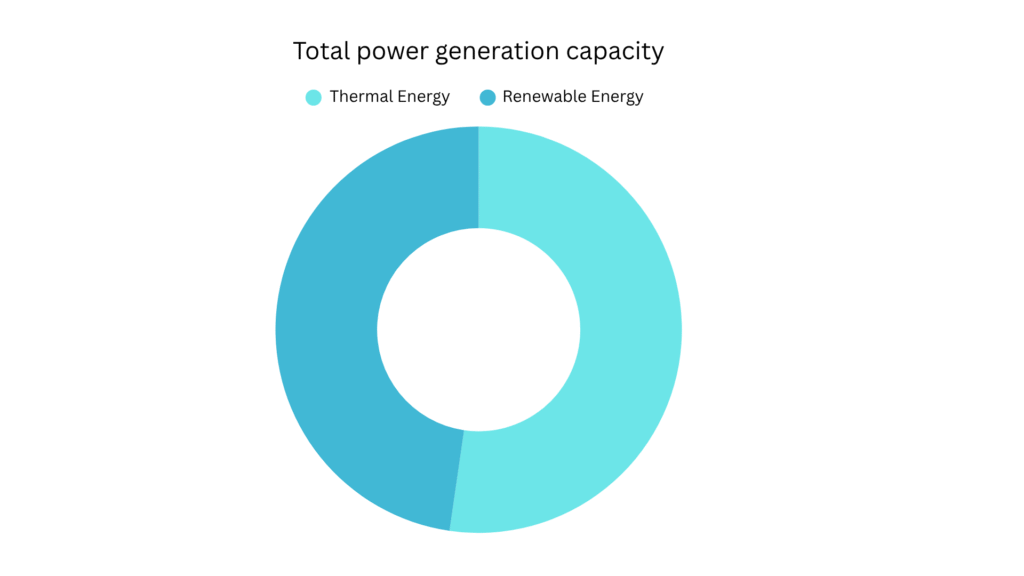

The company generates and sells power in India. It has Power generation capacity of 10,875 MW, which includes 5,658 MW of thermal energy and ~5,200 MW of renewable energy .

The company operates in the state of Karnataka, Punjab, Maharashtra, Tamil Nadu, Himachal Pradesh, Odisha, Andhra Pradesh, Telangana, Madhya Pradesh, Chattisgarh, Gujarat, and Rajasthan.

2. Power Transmission

Apart from power generation, company has an involvement in power transmission infrastructure through its subsidiary, JSW Energy (Transmission) Limited .

They own and operate transmission lines that transport power from power generating station to distribution points.

3. Power Trading

JSW Energy also engages in power trading, company is selling power on short term market by power exchanges or bilateral contracts. Power trading enables JSW to make profit from price swings in the short-term power market. When power demand rises, JSW can sell surplus power at higher rates to increase profitability.

In 2006, JSW Energy established JSW Power Trading Company Limited (JSWPTC), as a part of its strategy to become a full-spectrum power company. Today it is a significant power trading company in India.

4. Energy Storage

JSW Energy’s business model is fast evolving in response to the energy transition. The company is working on energy storage solutions that include battery energy storage system (BESS) and pumped storage. The company has target to have around 40 GWh of storage capacity by FY 2030.

5. New initiatives

They are also working on green hydrogen and ammonia generation projects in accordance with India’s National Green Hydrogen Mission. These projects are still in the early phase, but they have the potential of future growth.

Financial performance Analysis

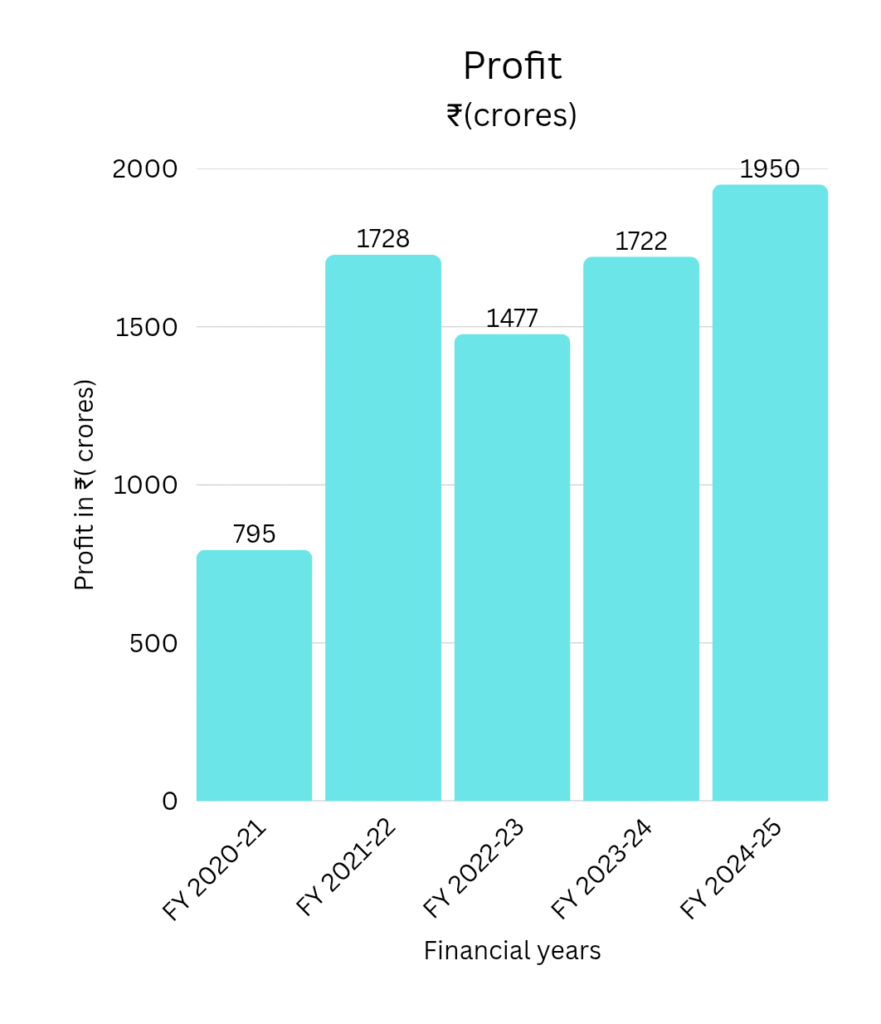

According to its recent annual and quarterly results, The company shows strong growth in revenue and profit, by the acquisition and renewable energy expansion. Its operational performance is strong, but this growth results in debt increase.

Revenue Growth

Profit Growth

Future plans

1. Energy Storage Expansion

The company plans to build 40 GWh of energy storage by 2030. This helps to balance power supply during day and night and ensures consistent power supply even when the sun doesn’t shine or wind doesn’t blow.

2. Focus on Renewable Energy

The company is rapidly moving towards renewable energy and reducing its dependency on coal. It aims to achieve carbon neutrality by 2050, that is perfect for long-term sustainability.

3. Growth Plan

JSW Energy plans to increase its total power capacity, from ~11 GW to 30 GW by 2030. The majority of new power will come from renewable sources such as solar, wind, and hydropower.

4. Smart Acquisition

The company wants to grow rapidly and has adopted the smart acquisition method to do so. Instead of buying everything from scratch , JSW plans to buy existing clean energy companies, this helps them to grow faster and achieve their goals easily.

5. Green hydrogen and nuclear power

JSW Energy is exploring new opportunities in green hydrogen, with a project for JSW Steel’s green steel production, and also in nuclear power.

SWOT Analysis of JSW Energy

SWOT is a strategic planning that stand for Strengths, Weaknesses, Opportunities, and Threats. This SWOT analysis of JSW Energy is helpfull for investors, to evaluate internal and external factors of the company.

Strengths

- The company has a diversified power portfolio, JSW Energy has a combination of thermal, hydro, and renewable energy projects, which reduces risk of dependency on single energy source.

- Focus on Renewable Energy, The company is expanding rapidly into solar and wind power, which perfectly align with India’s clean energy goals.

- Long-Term Power Purchase Agreements(PPAs), A substantial portion of revenue comes from long-term contract with state electricity boards and private players, this ensures steady cash flows and less uncertainty.

Weaknesses

- Dependence on Thermal Power, Even though renewable energies are expanding, but the reality is that thermal power still account a large portion of revenue and generation capacity. This dependence on thermal power puts the company under pressure.

- High Capital Costs and Borrowings, The company is increasing its debt in order to achieve its growth and storage goals,this increase finance costs and risk.

- Regulatory and Policy Dependency, The power sector is regulated by the government, therefore policy changes can have a significant impact. Tariffs, approvals, environmental standards, and other regulations are all subject to change.

Opportunities

- India’s Clean Energy Push, The Indian Government has implemented several initiative to promote green energy, such as National Solar Mission and various subsidies for solar and wind energy projects. JSW Energy is positioned to benefit directly from these initiatives.

- Technological Advancements, Technological Advancements such as Artificial Intelligence and Machine Learning for predictive maintenance can significantly reduce operational costs.

- Opportunity of International Expansion into emerging markets, New emerging markets such as Southeast Asia and Africa provide significant growth opportunities to JSW Energy. The Asia Pacific region is expected to witness a compound annual growth rate of 9.1% in energy demand.

Threats

- Volatility in Fuel Prices, Thermal power is generated by coal and gas, fuel costs are a big expense for energy generation. Any sudden price spikes directly effect margin of company. JSW Energy’s profitability is directly effected by fuel prices, particularly by coal and gas.

- High Competition, JSW Energy faces high Competition from both domestic and internation companies. Many companies are entering in renewable energy sector, that leads to high Competition.

- Regulatory Risks, The Indian Government has set goal to generate renewable energy, and aiming for 500 GW of renewable energy capacity by 2030. This move towards clean energy leads to regulatory changes that favours renewable energy projects over coal-based energy generation.

Investment Outlook For JSW Energy

1. Aggresive Capacity Expansion by 2030

JSW Energy has decided to expand its generation capacity to ~30 GW by FY 2030, and aims to build 40 GWh of energy storage. This strategic move to expand renewables and storage capacity, alligns with India’s green energy shift.

2. Focus on Renewable Energy

JSW Energy has shifted it’s focus from traditional thermal power to aggressively renewable energy( solar, wind, hydro). The company plans to generate 70-75% of it’s capacity from green energy by 2030.

3. Government Support

The Indian government is strongly supporting clean energy through policies, subsidies, and long-term net zero targets. This is in favour of JSW Energy because, Company allignes with this vision of government.

4. Long-term power deals

The company is singing 25 years contracts (PPAs) with government and private buyers, this ensures steady cash flows and reduces the risks.

FAQs

What is promoters holding in JSW Energy ?

The promoters holds majority of stake in JSW Energy, They possess approximately 69.26% of shares.

What are the major risks JSW Energy faces ?

The company faces major risks such as, fuel prices fluctuations, regulatory risks, debt and leverage, and competitive risks.

is jSW energy financially strong ?

Yes, JSW Energy is financially strong, It is continuously making profit from recent years.