The Indian Stock market in 2025 is full with opportunities, and one that has captured the attention of both small and large investors is Adani Power Shares.

With India’s increasing electricity demand, and government focus on ensuring reliable power, this stock has become one of the most talked-about stock of the energy sector.

About Adani Power

Adani Power Limited is a part of the Adani Group. Adani Power was established in 1996, It has grown to become India’s largest private thermal power producer.

Adani Power, operates an installed thermal power capacity of 18,110 MW spread across 12 power plants in Gujrat, Maharashtra, Karnataka, Rajasthan, Chattisgarh, Madhya Pradesh, Jharkhand, and Tamilnadu, apart from a 40 MW solar power plant in Gujarat.

Adani Power is on a path to achieve its growth potential, with the help of talented team in every field of power. The company is using technology and creativity to help India become a power surplus nation and provides quality, affordable electricity to all.

Adani Power is important for India’s economic growth by providing reliable power supply to both industrial and residential users. The company uses advanced technology, efficient fuel management, and excellent operations to ensure high availability and cost effectiveness in its services.

Mission Of Adani Power

Develop and adopt new technologies for sustainable operation Provide reliable power through un-interrupted power generation by improving the plant availability.• Create sustainable value for all stakeholders.

- Adani Power wants, To transform generating units from base load power plant to flexible operation to contribute to the energy security of the country.

- To develop and adopt new technologies for sustainable operations of units leading to lower emissions.

- To reduce power generation cost through efficient operations, that makes the power more affordable to all.

Adani power Share Price History

For long-term investors It is very important to understand that, how a stock has moved over time. Let us take a quick look at Adani Power Share price history(here we are discussing real price).

2009

Adani Power was listed on stock exchange at around Rs.100 per share.

2010-2014

Stock faced many ups and downs due to rising debt, insufficient coal supply, and regulatory challenges. Adani Power share traded mostly under Rs.150.

2015-2019

The share fall and adani Power share traded between Rs. 25 to Rs. 70 due to high debt and losses.

2020(Covid Crash)

During pandemic market got crashed, the share share even traded around Rs.40, but this is golden opportunity for new buyers to buy share.

2021-2022

Stock started gaining momentum, price reach up above Rs.300(real price).

2023

Due to impact of Hindenburg Report, Adani Power share price dropped sharply,it reached upto below Rs.150(real price).

2024

After stabilizing operations, debt reduction, profit growth it’s share started to recover and it crossed over ₹ 600(real price).

7 Powerful Reasons to Watch Adani Power Share in 2025

Let’s explore the reasons to watch Adani Power share in 2025.

1. Increasing Power Consumption

As India is moving forward towards development, the demand for electricity is also increasing rapidly. Adani Power is an important thermal power player, benefits from India’s expanding power consumption.

In india electricity consumption is increasing due to Urbanization, Industrial growth, Digital lifestyle and data centre.

2. Focus on Renewable Energy Generation

Allover the world each and every power producing company is moving towards clean energy like solar, wind, and hydro because thermal power create pollution. Global investors prefer companies that focuses on green energy.

Adani Power concentrate on thermal power, But it produces renewable energy indirectly through its sister company company, Adani Green Energy Limited. Adani Green Energy Limited is a big renewable energy company, that operates solar, wind, and hybrid power plant across India.

Focus on renewable energy generation is important because, it reduces long-term risk. Even if coal-based power generation faces restrictions, then Adani Power can easily shift towards green energy with the support of it’s sister company Adani Green Energy Limited.

3. Government Focuses on Energy Security

Energy security means to make sure that, India always has enough energy to power homes, factories, and industries without dependence on foreign countries.

India imports a lot of coal and oil from foreign countries for power generation, which makes us dependent on global markets. If global prices rise, then directly it effect indian economy.

To ensure energy security government is supporting Indian company by various schelike subsidiary, and UMPPs.

India imports a lot of coal and oil, which makes us dependent on global markets. If global prices rise, costs go up.To avoid this, the government wants more electricity to be produced inside India itself with the help of renewable sources.

4. Industrial Growth In India

India is working hard to build $5 trillion economy by 2030. To reach this, the country requires rapid expansion in manufacturing industries, technology, data centres and transportation, for expansion all these sectors requires large of electricity.

For industrial growth, electricity(power) is a basic requirements. Adani Power is a leading power producer, it plays a important role in power supply to various industries.

Adani Power is one of the company that assures consistent and reliable power supply to every sector. As industries grow, the demand for power will increase, resulting in growth of Adani Power Share.

5. Rising Investors Confidence

Stock market is not just about numbers, it is also about trust and confidence of investors in a stock. When investors trust a company, its share price tends to rise.

Adani Power generated Rs.205 billion of funds from operations in FY25. It expects to generate FFO of Rs. 1230 billion over the next six years. Adani Power has resolved all pending regulatory matters and recovered all pending regulatory dues, including carrying costs and late payment surcharges, This rises trust and confidence in investors about Adani Power share.

6. Strategic Acquisition and Expansion

Adani Power expands its business by strategic Acquisition of properties and assets. such as –

- Adani Power purchased distressed assets( problematic properties in Maharashtra and Rajasthan.

- It restored useless plant through better management and operations.

This results in easily expansion without wasting too much efforts, time and money to new initiatives.

Adani Power is continuously growing and expanding for the growth of revenue and profit.

7. Strong Financial Performance

Before investing in any company, the investor checks whether it is financially strong or not. Adani Power is a financially strong company.

Adani Power is showing strong financial performance, with substantial profit growth from previous loss to substantial profit. The company experienced strong growth in revenue and profit in the past few years.

Adani Power has reduced its lone in recent years. Strong Financial Performance of a company attracts more Investors for long term growth.

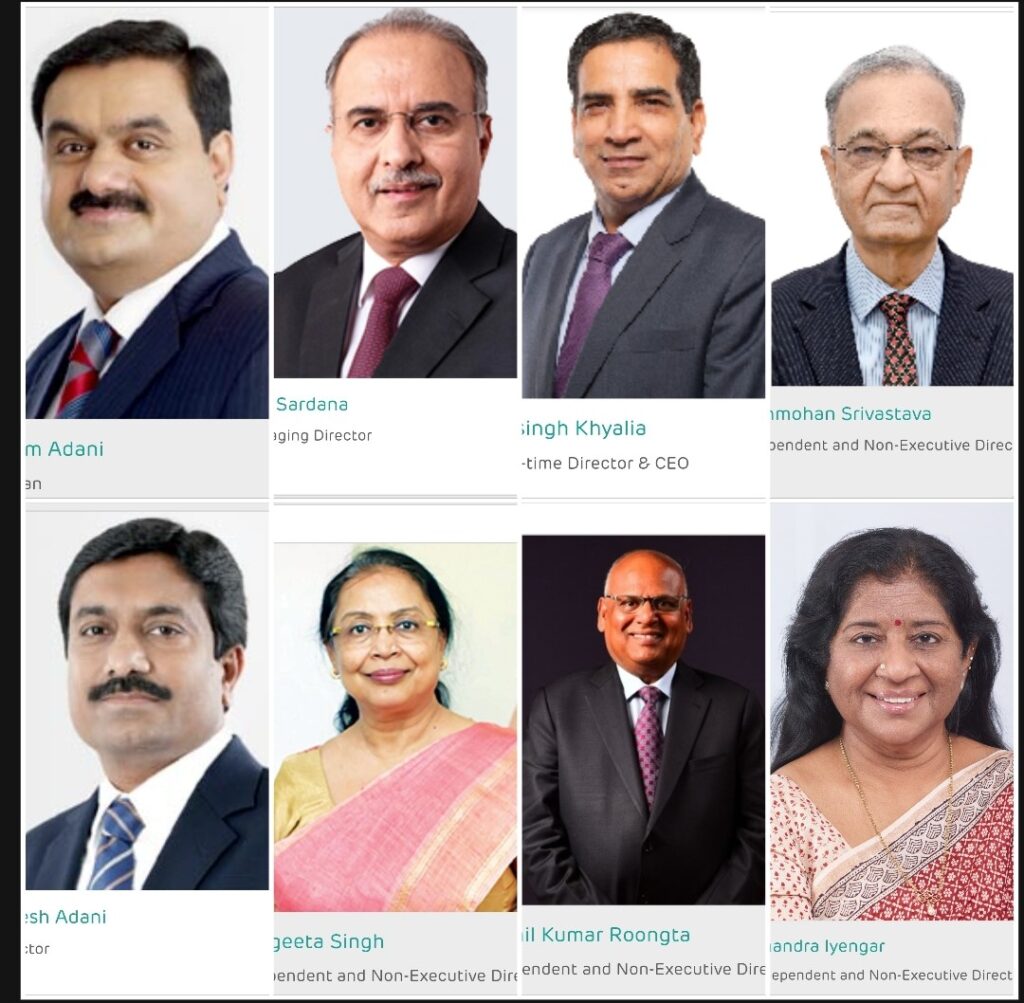

Adani Power’s Board of Directors

- Chairman – Gautam Adani

- Director – Rajesh Adani

- Managing Director – Anil Sardana

- Whole-time Director & CEO – Shersingh Khyalia

- Independent and Non-executive Director – Chandra Iyengar

- Independent and Non-executive Director – Sushil Kumar Roongta

- Independent and Non-executive Director – Sangeeta Singh

- Independent and Non-executive Director – Manmohan Srivastava

FAQs

Is Adani Power is a good Stock to buy in 2025 ?

Yes, Adani Power is a good stock to buy in 2025, it can become a good investment option. There is high chances of it’s growth. But before investing in it, reserch properly.

Does Adani Power invest in Renewable Energy ?

Adani power is not involved directly in renewable energy, but it’s sister company Adani Green Energy Limited is a big renewable energy company, that operates solar, wind, and hybrid power plant across India.

Why Adani Power share rises so much in 2024 ?

Adani Power share rises in 2024, because of profit growth, and debt reduction.

What is Real price of a stock ?

The real price is the actual market price of a stock, that you see on the stock exchange at any given time. It is a price at which a stock is trading.

What is Adjusted Price Of a Stock ?

The Adjusted Price of a stock is that has been modified to reflect important corporate actions or economic factors.